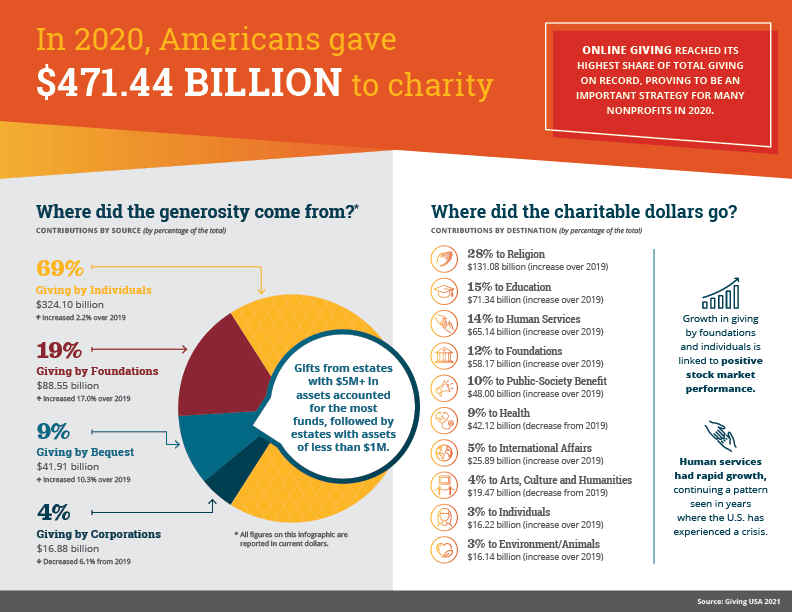

Did you know Americans gave $471.44 billion in 2020 to qualified charities? Also, in 2020, online giving increased by 20.7% taking an even larger slice of total giving overall at 13%.1

Nothing In This World Compounds Like Giving

Nothing In This World Compounds Like Giving

Lydia Gosselin

Wealth Advisor, Client Service Manager

If you have been giving regularly to causes you and your family support, have you been giving in the most efficient way? There are creative ways to plan your regular giving through the following ways:

Qualified Charitable Distributions (QCD):

A Qualified Charitable Distribution (QCD) can be made directly from your Retirement Account to a 501(c)(3) organization and can also count towards the Required Minimum Distributions if you are taking it currently or when you must take a distribution at age 72. You can direct the gifts to the charities you support. The benefit of gifting from a retirement account is to allow direct gifting of funds that have grown tax-deferred for many years.

Donor Advised Fund (DAF):

A donor-advised fund can be funded with cash, highly appreciated securities, life insurance and real estate. The gift is made to the nonprofit organization (i.e.: United Charitable) and the amount is deducted in the same year as with other charitable giving. The difference is that you can postpone giving the funds to specific charities until the next year or even years after while the funds are invested and growing. This allows you have time to consider your overall giving strategy and further research the causes you and your family wish to support.

Direct Stock Gifts:

Gifting appreciated stock directly from a non-qualified account to a charity may also be an option for you to consider. You can realize the tax deduction while reducing your overall potential tax liability.

Reach out to ask us more about creative philanthropy solutions that would best meet your goals! We would be happy to put together a strategic giving plan for you and your family working together with your tax advisor as well.

Sources:

1Giving USA 2021